Crypto Portfolio Thought Piece

A showcase of two indexes I'm building

Problem Statement

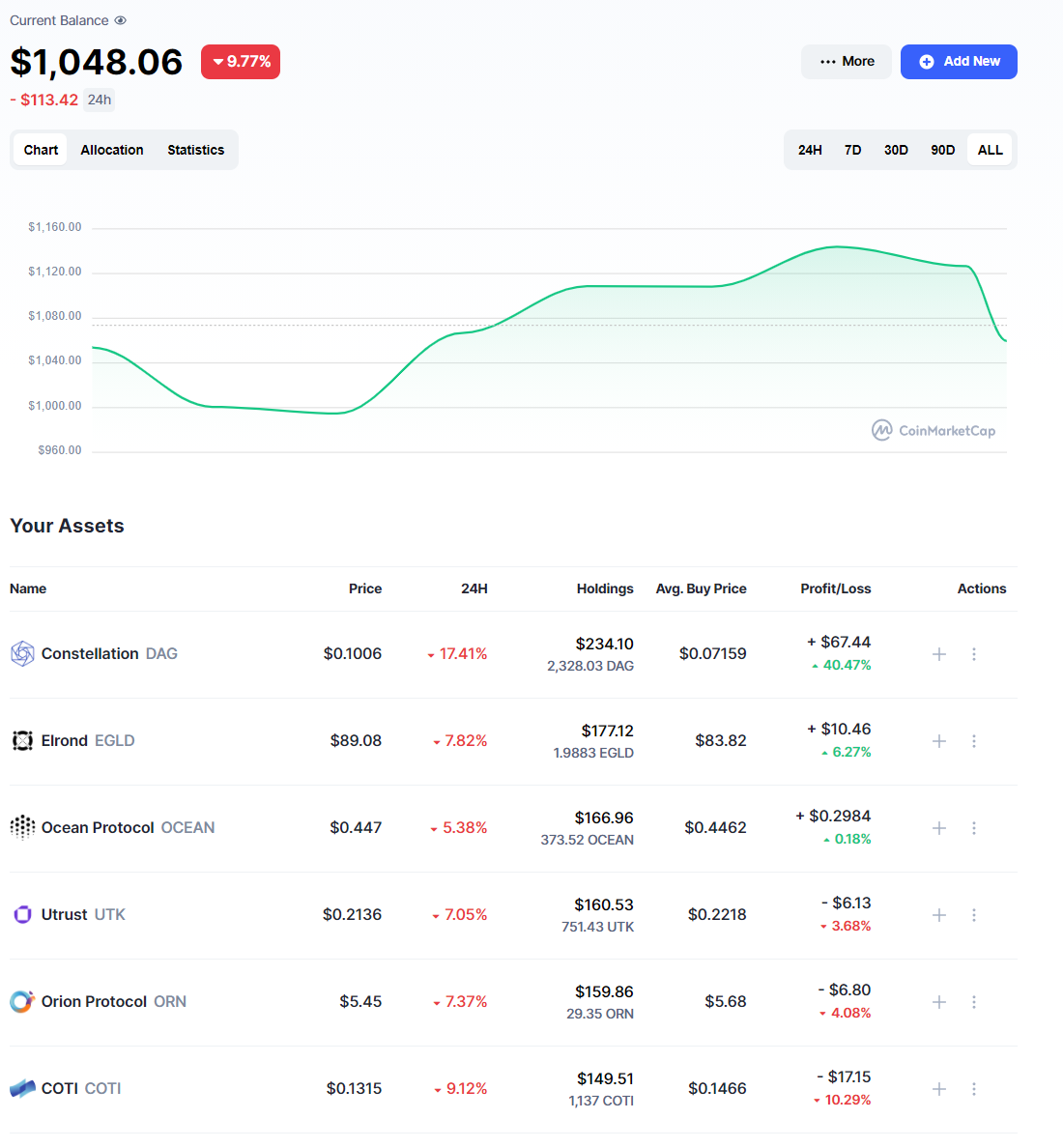

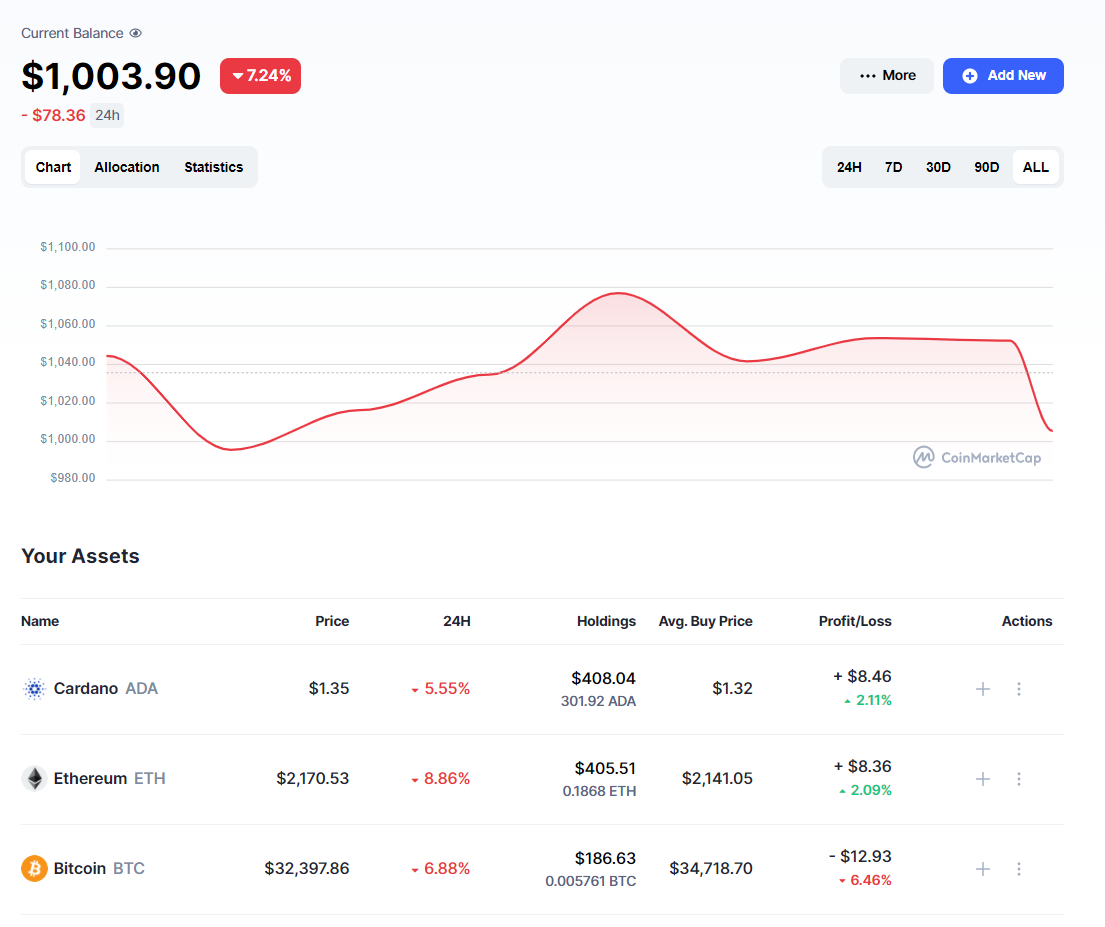

In this markdown I wanted to track two different portfolios. A high risk portfolio of low marketcap cryptocurrencies which I’ve curated based on some fundamental analysis and a large market capital portfolio consisting of Bitcoin, Ethereum and Cardano. The goal of this post is to show the returns of $1000 USD in both portfolios starting the 1st of July 2021. The reason I have not back dated the portfolios to showcase past performance is because ‘would have, should have’.

Methadology

The HIGH-RISK-HIGH-REWARD (HRHR) portfolio contains 6 cryptocurrencies I’ve personally researched and look to have promising value additions in the space (NOT FINANCIAL ADVICE). The index equally splits the capital between the 6 cryptocurrencies and redistribute every 6 months on the 1st of January and 1st of July. The GIANT-CAP portfolio contains 20% Bitcoin, 40% Ethereum and 40% Cardano as a benchmark to compare the returns of the HRHR portfolio. The same redistribution logic applies to this portfolio on the same dates.

Risk

My hypothesis is over a span of 5-10 years the HRHR, portfolio will show signficantly better risk adjusted returns than the GIANT-CAP portfolio. This blog post will be updated at least once a month to show the progress.